In 2025, currency fluctuations remain one of the most influential forces in shaping both national and global economies. As countries face shifts in inflation, trade, and investment, understanding how exchange rates affect daily financial dynamics is essential for businesses, investors, and policymakers alike.

What Are Currency Fluctuations?

Currency fluctuations refer to the daily changes in the value of one currency against another. These movements are driven by factors like inflation, interest rate differences, geopolitical developments, and government policies. The impact is far-reaching—affecting everything from import prices to business expansion strategies.

For a complete overview of active global currencies, see the List of Circulating Currencies on Wikipedia.

How Exchange Rates Affect Inflation

When a country’s currency depreciates, it makes imported goods more expensive. This leads to increased costs for raw materials, fuel, and consumer products—causing inflation. On the other hand, a strong currency reduces import costs but may harm exports by making them pricier in global markets.

Currency Trends: Q1 2025

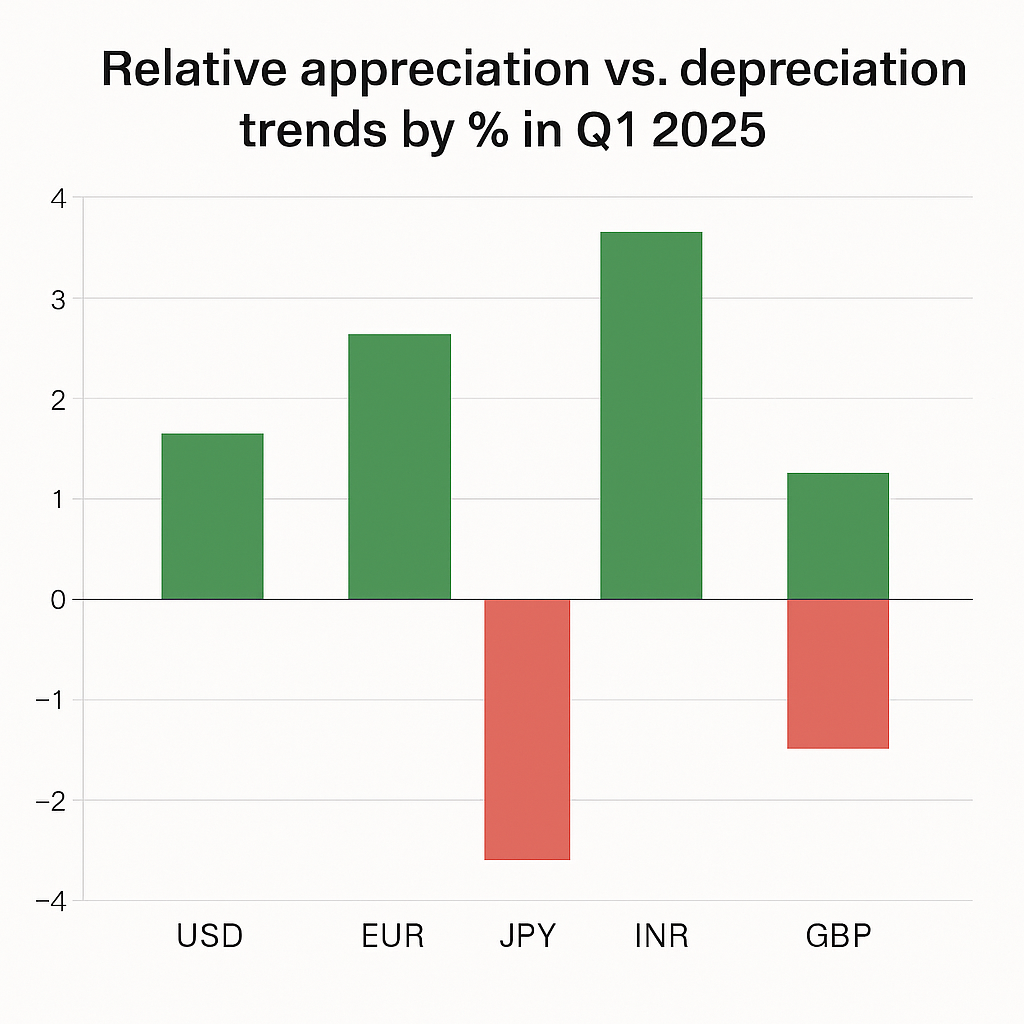

The following chart illustrates the relative appreciation and depreciation trends of major global currencies during the first quarter of 2025.

Fig 1: Currency performance based on Q1 2025 reports. Positive values indicate appreciation; negative values indicate depreciation.

Exchange Rates and Trade Balances

Currency strength influences a country’s exports and imports. A weaker currency boosts exports by making goods cheaper abroad, while a stronger currency makes imports cheaper for consumers at home. Here’s a snapshot of trade balance performance in relation to currency movements:

| Country | Currency Change (Q1 2025) | Export Trend | Trade Balance Impact |

|---|---|---|---|

| United States | +2.1% USD | -1.5% | Higher Imports, Mild Deficit |

| Japan | -4.3% JPY | +3.8% | Improved Surplus |

| India | -1.9% INR | +1.2% | Neutral Effect |

| Germany | +0.9% EUR | -0.5% | Stable Balance |

Source: IMF World Economic Outlook, April 2025

Foreign Investment and Currency Volatility

Volatile exchange rates increase uncertainty for international investors. A depreciating currency can reduce returns when profits are converted back to the investor’s home currency. In 2025, countries like Switzerland, Canada, and Singapore remained top investment destinations due to monetary stability, while nations experiencing high currency swings saw declining foreign direct investment (FDI).

Business Risks from Currency Swings

Businesses that trade globally or rely on imports must actively manage currency risk. Tools like forward contracts, options, and multi-currency accounts can help mitigate losses. For small and medium enterprises (SMEs), sudden currency dips may lead to rising costs and lower margins, especially if they price goods in foreign currencies.

Expert Reports: 2025 Insights

- The International Monetary Fund (IMF) noted that emerging markets saw up to 22% inflation variation directly tied to currency fluctuations.

- The Bank for International Settlements (BIS) stated that short-term volatility has reduced globally, but long-term currency misalignments remain a risk.

- According to the World Economic Forum, exchange rate unpredictability is now one of the top 5 economic concerns among global CEOs in 2025.

How to Manage Currency Risk

To protect against losses and instability, governments and corporations are using these key strategies:

- Hedging: Using financial tools like forwards and swaps to lock in exchange rates.

- Geographic Diversification: Expanding into multiple markets to minimize regional currency exposure.

- Local Pricing: Charging in local currency to avoid foreign exchange losses.

- Monitoring Central Bank Announcements: Staying updated on monetary policy changes that affect currency movements.

Conclusion

Currency fluctuations are not only an indicator of economic strength but also a force that actively shapes inflation, trade, and investment across borders. In 2025, understanding these movements and their ripple effects is more critical than ever. Businesses and governments that stay informed and adapt accordingly will be better equipped to thrive in the global economy.

Interested in starting a venture that can survive such fluctuations? Explore Small Business Opportunities for 2025 to learn more.

Sources

- IMF World Economic Outlook, April 2025

- Bank for International Settlements Statistics

- World Economic Forum Global Risks Report 2025

- UNCTAD World Investment Report